Aapl Apple Calling Again the Pullback in World Indices

sakkmesterke/iStock via Getty Images

Apple's (NASDAQ:AAPL) stock has gone on another ballsy run higher, pushing its market cap to nearly $2.9 trillion. That's almost the aforementioned size as India'south GDP of $3.0 trillion, the world'southward sixth largest economy.

At that place is no doubting Apple tree's business model and its massive almanac revenue totals. But since Oct. iv, Apple tree's market cap has risen by nearly $600 billion, or the size of Sweden's GDP.

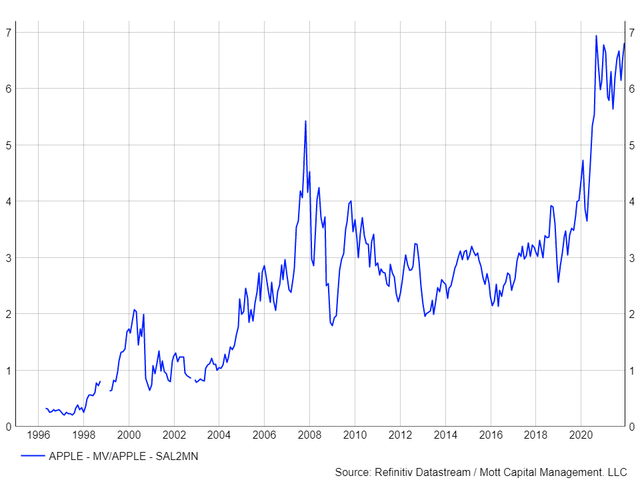

It likewise pushed Apple'due south price-to-sales ratio back to historically very loftier levels. The last time Apple's one-year forwards price-to-sales ratio was this high was dorsum on Sept. one, 2020. It has never been college.

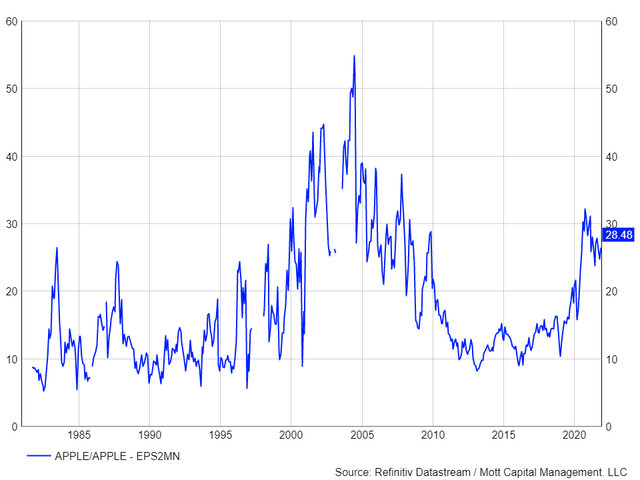

Meanwhile, the stock's PE ratio has risen back to 28.l, which is reaching its post-COVID high of 34 in September of 2020, or 32.v in January 2021. The but time the stock had a higher PE was in the early on 2000s when it was a visitor fighting for its survival.

The move college in the stock doesn't seem justified at the moment given, supply bondage concerns that came upward during the fiscal quaternary quarter briefing call and the recent reports of a supply chain crunch.

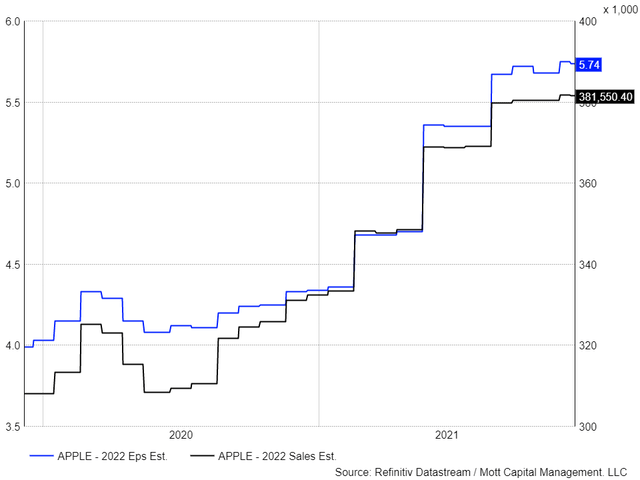

Additionally, despite the enthusiasm of the stock, analysts don't seem nearly every bit enthusiastic, and to this indicate, have been slow to arrange their earnings and sales estimates higher. Now, mayhap the stock marketplace is leading the way, and analysts volition soon follow. But to this point, information technology hasn't happened.

It means that earnings growth for 2022 would be just 2.3%, and revenue growth of 4.3%, which is undoubtedly proficient growth for a company of its size, but not stellar growth.

AAPL Gamma Squeeze

The reason why Apple tree appears to be ascension has everything to exercise with the options market and not the fundamentals. This is fine, but generally, it tin can go out a mess behind when the options market finishes playing. It doesn't ever have to lead to a stock dropping sharply, but information technology can lead to an increasing corporeality of volatility every bit a stock deflates - Tesla (TSLA) and Nvidia (NVDA) are two such examples.

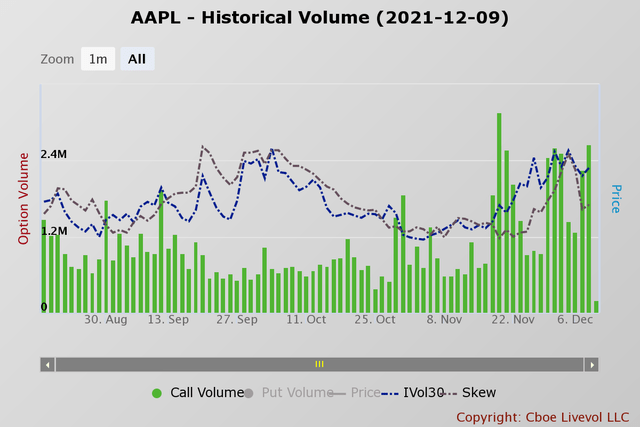

Based on the latest data, it appears that Apple is in a gamma squeeze. The concept of a gamma squeeze is quite uncomplicated. It'southward like a short-squeeze but driven by options. It starts with a ascension in call book, which has undoubtedly been the case for Apple over the by few trading sessions.

Typically, this phone call volume is for a brusk-term outlook, with an expiration date that is relatively soon. For Apple, most of that call volume has centered around expiration dates before year-end.

The heavy call volume forces the market makers in Apple to most likely buy the underlying, as information technology'due south the most liquid way to hedge the option position. Market makers can sometimes expect to stock futures or other call options, but buying the underlying seems to make the about sense in about cases.

When customers are buying calls, the market maker is selling the calls most of the time. The squeeze begins because the more customers buy, the more hedging the marketplace-maker needs to do. Additionally, the more than the stock rises, the more than hedging the market-maker needs to stay appropriately hedged. This hedging outcome is completed past ownership the underlying, which is, in essence, a gamma squeeze.

Finding The Squeeze

1 way to identify a gamma squeeze is by looking at the skew of the options. We accept seen the skew in Apple fall dramatically since December 3, indicating that investors are paying more than for a call relative to a put. The more skew falls, the more than expensive the calls options are than the puts. Additionally, implied volatility levels accept risen because the market-makers go far more than costly for customers to buy the call. Since the market-makers are taking on more hazard, they are looking to be paid more than for that added gamble.

Somewhen, the premium is so expensive they are no longer worth trading. Customers begin to back abroad from buying the calls, resulting in the call volume starting to irksome, unsaid volatility receding, and the skew rising. It will drop the stock toll, forcing the market-maker to sell the disinterestedness and unwind its hedges.

Technical Warnings Signs

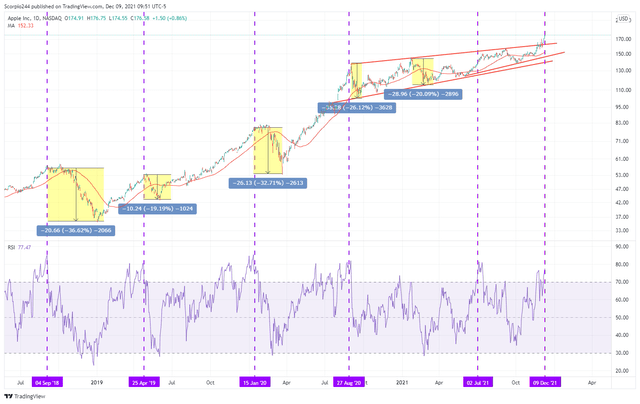

Apple tree's RSI is also significantly elevated, trading above 70, indicating that the stock is overbought at electric current levels. Typically, when Apple tree's RSI reaches a level higher than lxx, at to the lowest degree since 2018, the shares have suffered a sizable pullback. The one time there wasn't a pullback was in July 2020. Other examples showed drops of effectually 20% and more 30% in some instances. A similar retreat would take the stock back to its long-term uptrend of Baronial 2022 to nearly $140.

The movement higher in Apple does appear to exist centered around increasing activity level in the options markets, with very little of the motion higher having to do with the fundamentals of the business organization. The risk of playing with a stock caught up in a gamma squeeze is figuring out when information technology will end and the carnage that ensues after it.

Investing today is more complex than ever. With stocks rise and falling on very little news while doing the opposite of what seems logical. Reading the Markets helps readers cut through all the noise delivering stock ideas and market updates, looking for opportunities.

We utilize a repeated and detailed process of watching the fundamental trends, technical charts, and options trading data. The process helps isolate and make up one's mind where a stock, sector, or market place may be heading over various time frames.

To Notice Out More Visit Our Abode Page

davisbuttephon1999.blogspot.com

Source: https://seekingalpha.com/article/4474393-apple-aapl-stock-overbought-may-crash

0 Response to "Aapl Apple Calling Again the Pullback in World Indices"

Mag-post ng isang Komento